ICBA ECONOMICS: A Closer Look at Canadian Construction Companies

By Jock Finlayson, ICBA Chief Economist Construction is one of the biggest industries in the country, whether ranked by total business revenues,...

.png)

Data on construction prices are collected regularly and reported quarterly by Statistics Canada. They provide information on the change over time in the prices charged by contractors to construct new buildings across urban Canada. The building construction price index published by Statistics Canada captures all parts of building construction – residential, commercial, industrial, and institutional.

What’s actually included in this broad indicator of “construction inflation”? Statistics Canada notes that “the contractor’s price reflects the value of all materials, labour, equipment, overhead and profit to construct a new building.” The construction price index does not capture value-added or property taxes, nor costs related to land acquisition/assembly, land development, building design, or real estate taxes/fees. In quantitative terms, the building construction price index is mainly driven by trends in the cost of labour and construction materials. Equipment costs and overhead/profit margins tend to be more stable.

The last several years have seen rapidly escalating construction costs in Canada, which have been reflected in building construction prices across the entire industry. Steadily rising building costs have fueled worries about housing affordability, contributed to the soaring cost of developing new and refurbishing existing public infrastructure, and help to explain the contemporaneous decline in Canada’s competitiveness.

The most recent data from Statistics Canada are for the third quarter of 2025. They allow us to see what’s happened to construction costs/prices since the onset of the COVID-19 pandemic in early 2020. The picture is not comforting.

The first accompanying figure summarizes the percentage change in building construction prices at the national level, from the third quarter of 2019 through Q3 of 2025. As shown, on average across urban Canada residential building prices jumped by almost 70%, while for non-residential buildings the increase was smaller but still significant at 42%. Within the non-residential segment, construction prices climbed by 51% for industrial buildings and by 42% for commercial structures.

Figure 1

These numbers point to substantial cost/price escalation in the Canadian construction industry, well in excess of average economy-wide inflation. If there is any good news, it’s that the pace of price increases has generally moderated over the last year or so. That said, in 2025 tariffs and supply chain uncertainties caused upward pressure in the prices of some construction materials (like steel), even as earlier labour shortages and other construction-related “inflationary” factors eased.

The second accompanying figure provides the same information for B.C. and Alberta over the period Q3 of 2019 to Q3 of 2025. Developments in these two provinces approximately match those at the national level.

Figure 2.png?width=940&height=788&name=Building%20Construction%20Price%20Index%20(B.C.%20%26%20Alberta).png)

Looking at the entire six-year period 2019-2025, the rising cost of building construction was due to a number of factors: pandemic-era supply chain and materials price shocks; skill and wider labour shortages in the Canadian construction industry, leading to upward pressure on employee wage and benefit costs; changes to building codes, energy efficiency rules and other areas of government regulation which further added to the cost of constructing buildings; escalating municipal and regional development cost charges and other taxes/fees; and the impact of Canadian tariffs on imports of some construction materials. All of these trends are reflected in the building construction price data collected by Statistics Canada.

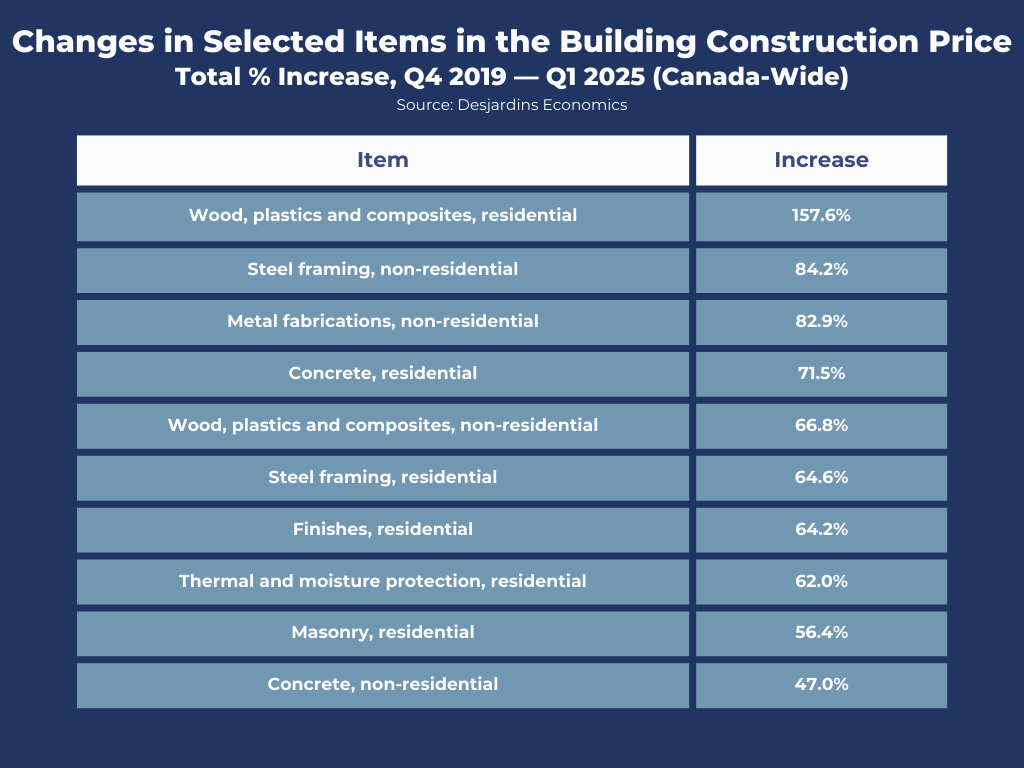

Below are data on the cumulative increases in the prices of various materials used in Canadian construction from late 2019 through the first quarter of 2025, taken from a recent report by Desjardins. Data were collected separately for inputs used in residential and non-residential construction, and these are reported separately. Some of the price hikes are staggering, particularly considering that overall Canadian inflation stood at 17.2% over the same period.

Figure 3

With the federal and some provincial governments focused on accelerating housing supply, advancing major industrial and infrastructure projects, and seeking to kick-start languishing business investment, it’s a safe bet that Canada will see sustained, strong demand for skilled labour across most segments of the construction sector in the years ahead. Desjardins notes that “labour costs are now the primary driver of rising construction expenses.”

There are no silver bullets to alleviate high and rising building construction prices, but the situation is not hopeless. For policymakers and construction industry leaders, the required call to action should include commitments to the following key steps:

By Jock Finlayson, ICBA Chief Economist Construction is one of the biggest industries in the country, whether ranked by total business revenues,...

ICBA Economics has released the Winter 2026 Construction Monitors for British Columbia and Alberta—two quick, data-rich snapshots of what’s happening...

By Jock Finlayson, ICBA Chief Economist As temperatures cool and winter approaches, the Canadian construction industry may welcome the looming end of...