ICBA ECONOMICS: A Snapshot of Exports and Jobs in Canada

By Jock Finlayson, ICBA Chief Economist As U.S. President Donald Trump continues to wave his tariff wand at Canada and other American trading...

%20(1).png)

Key Takeaways for Alberta Construction Businesses:

Canadian policymakers, elected officials, and media commentators are fond of referencing the role and contributions of “small business” when talking about our economy and its growth prospects. This is true at all levels of government right across the country, including Alberta. Small businesses are found in every village, town, city and commercial district. Almost every voter and local resident has frequent direct contact with small enterprises and at least some entrepreneurs in their community. Small businesses, in other words, are eminently “relatable”to the average citizen, in ways that larger Canadian companies – to say nothing of giant multinational enterprises headquartered abroad -- may not be. As discussed below, small businesses also figure prominently when we examine the construction industry in Alberta.

According to the system of business statistics developed by the Government of Canada, “small businesses” are those with between 1 and 99 paid employees. Businesses with 100 to 499 employees are classified as “medium-sized,” while those with 500 or more are placed in the “large business” category. It should be noted that under this framework for collecting business statistics, tiny “one person”ventures with no paid employees (other than a single owner-operator) are not included in the official business count.

Based on the above definition, Canada is home to a little over 1.1 million businesses of all sizes, with 98% of these classified as “small” by the federal government (i.e., fewer than 100 paid employees). These small businesses directly employ almost 6 million Canadians, representing 46% of the total private sector labour force. Large businesses account for about 36% of the private sector workforce while medium-sized firms employ another 17%. Again, the figures cited in this paragraph exclude one-person business operations with no paid employees apart from an owner.

The Situation in Alberta

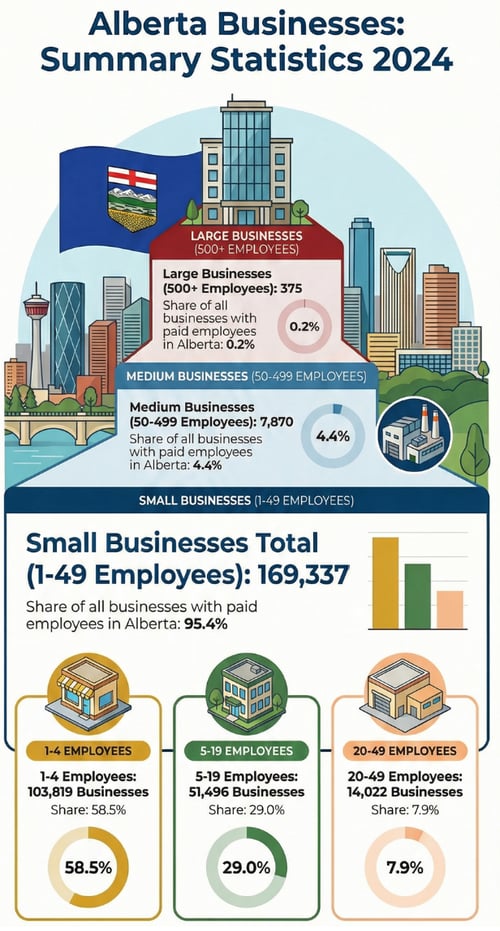

The Government of Alberta also collects and publishes data on small businesses. However, somewhat confusingly, it uses a definition that differs from the one adopted by the Government of Canada. Specifically, Alberta attaches the label “small business” to firms with 1-49 paid employees, rather than the 1-99 employee definition used by the federal government.

Figure 1 provides summary data on all businesses in Alberta with paid employees, capturing small, medium-sized and larger firms. As shown, more than 95% of registered Alberta businesses have 1-49 workers. Another 4.4% fall in the medium-sized category, while just 0.2% of all Alberta businesses (just 375 firms) meet the 500-employee threshold required to be classified as “large”. The latter figure may surprise some readers, but it must be recalled that the large enterprises included in the Alberta government’s business profile only capture those that are legally headquartered in the province. Big companies with a presence in Alberta but whose head offices are located elsewhere (e.g., Royal Bank of Canada, Google Canada, Ledcor) are not included in the 375 large Alberta companies referenced in Figure 1.

Figure 1

Figure 2 shows the distribution of employment by size of firm in Alberta as of 2024. Small employers account for 35% of private sector jobs, compared to 26% for medium-sized businesses and 39% for larger firms. These shares have been stable over the last decade.

Figure 2

Nationally, the number of small businesses -- using the Alberta government’s definition (1-49 employees) per 1,000 people -- stands at 31.2. The figure is higher in Alberta: 34.3 in 2024, suggesting that Alberta provides a more favourable environment for small business ventures and start-up firms than most other provinces.

Construction is a very prominent part of Alberta’s small business community. In 2024, construction provided the second largest number of small businesses in the province (20,536), exceeded only by professional, scientific and technical services (22,672). Construction firms make up approximately 15% of the small businesses operating in Alberta. In every region of the province, construction ranks either first or second in the number of businesses.

Construction’s impact on the wider Alberta economy is even greater when attention shifts from counting companies to measuring employment. In fact, construction is the number one small business employer among all private sector industries in Alberta (Figure 3).

Figure 3

An important feature of a vibrant business environment is the extent to which new companies are formed and how this compares to the “exit rate” among existing businesses. Both business entry and exit help to drive and shape innovation, industrial change, and overall economic growth in a well-functioning market economy. It is therefore disconcerting that the rate of new business formation in Canada has slowed in the last 10-15 years – with the same trend evident in Alberta in the last few years. For example, over the course of 2024, the number of new businesses entering the market in Alberta each month trailed the number that closed down or disappeared for other reasons. That is not a pattern that we would want to persist indefinitely.

Policymakers looking to foster a strong economy need to support, stimulate and reward entrepreneurial activity – both new business ventures as well as the growth of existing SMEs. A dynamic market economy depends on entrepreneurial wealth creation and the emergence of successful medium-sized and larger companies from among the ranks of the vast number of smaller firms that populate the private sector.

By Jock Finlayson, ICBA Chief Economist As U.S. President Donald Trump continues to wave his tariff wand at Canada and other American trading...

https://youtu.be/GRUDkFzLDjk

The following piece, by ICBA Chief Economist Jock Finlayson for the Fraser Institute, first appeared in the Calgary Sun on April 2, 2025.