CANADA VOTES 2025: ICBA’s Federal Election Toolkit

ICBA, Canada’s largest construction association, is pleased to offer our members information, analysis and recommendations leading up to the 2025...

2 min read

Jock Finlayson : Updated on February 9, 2026

Statistics Canada’s latest survey of corporate headquarters provides updated counts of head offices and direct head office jobs for each province as well as the country’s main metropolitan areas. The survey allows analysts to understand to what extent individual provinces and Canadian cities have been successful in growing the “corporate economy” in their respective jurisdictions.

The survey covers both publicly-traded and privately-owned companies as of 2024. A head office is defined as an “establishment… primarily engaged in providing general management and/or administrative support services” to affiliated operations and lines of business owned by the company in question. In most cases, a head office oversees facilities/operations located in more than a single community.

Basically, this definition of head offices captures large and mid-sized Canadian-headquartered companies spanning all sectors of the economy. In B.C., a few examples of large locally-based firms are Canfor, Tolko Industries, Polygon Homes, Beedie Group, London Drugs, Teck, Coast Capital Savings, and Ledcor Industries. Some notable large Alberta-based companies are Suncor, Canadian Natural Resources, Interprovincial Pipelines, Enbridge, and Canadian Pacific Railway. The head office survey also counts companies that are headquartered in Canada – including B.C. and Alberta -- and whose activities are dispersed widely. For example, many successful Canadian companies included in the survey have invested and built a presence in the United States, while others have established or acquired businesses in Europe, Asia and Latin America. Indeed, in dollar terms, the stock of Canadian foreign direct investment abroad now exceeds the stock of foreign direct investment in Canada. This represents a reversal of the pattern that prevailed in the decades before 2000.

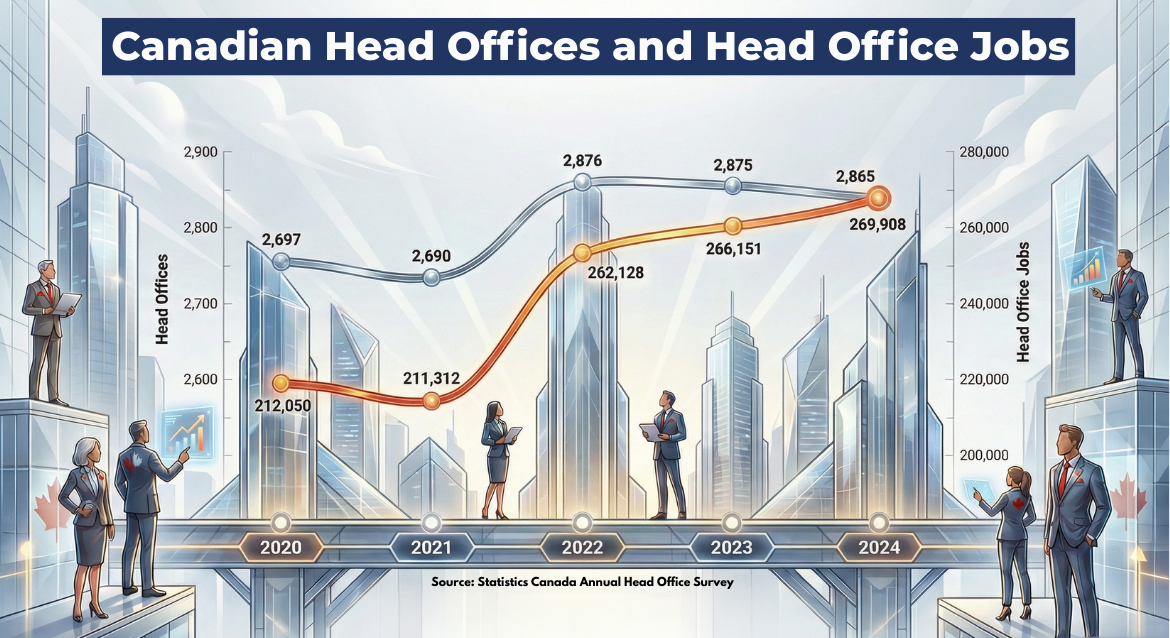

Figure 1 shows the number of head offices, as well as direct head office employment, nationally from 2020 to 2024. Figure 2 provides the same information for British Columbia and Alberta. Figure 3 shows the number of head office jobs per thousand employed people in the four largest provinces in 2024.

Figure 1

Figure 2

Figure 3

A few points are worth noting:

Within Canada, Ontario accounts for the largest share of corporate head offices and head office jobs, followed by Québec. The Greater Toronto Area alone hosted one-quarter of Canada’s head offices and 31% of all head office jobs as of 2024.

The presence and growth of head offices is an important source of economic dynamism and contributes in multiple ways to the economic well-being of the cities and regions in which they are located. A robust corporate sector acts as a powerful economic driver by expanding high-paying employment – both directly, as well as in local industries that supply services and other inputs to head offices – and by boosting government tax receipts. Research also confirms that strong head office clusters are associated with greater non-governmental financial support for health care, educational and cultural institutions, as well as for charitable activities.

ICBA, Canada’s largest construction association, is pleased to offer our members information, analysis and recommendations leading up to the 2025...

SURREY – British Columbia is staring down another difficult year, with ICBA forecasting real GDP will expand by a meagre 1.1% in 2026 – a level that...